michigan use tax registration

I want to sell my product at one show in Michigan and I dont have a Michigan sales tax license. 2018 Sales Use and Withholding.

Michigan Sales Use Tax Registration Service Harbor Compliance

Michigan has a flat income tax rate of 425.

. Vehicle registration late fee. Since electric vehicles dont burn as much gas or none at. A sales tax license can be obtained by registering the E-Registration for Michigan T a xes or submitting Form 518.

Minimum 6 maximum 15000 per. Michigan Sales Use Tax Licensing Licensing requirements for Michigan businesses. LoginAsk is here to help you access Michigan Sales Tax Registration Form.

Register for a Michigan Sales Tax License Online by filling out and submitting the State Sales Tax Registration form. For transactions occurring on and after October 1 2015 an out-of-state seller may be. Michigan Local City Payroll.

The State of Michigan collects taxes for roads through a fuel tax and sales tax on that fuel as well as registration fees. MTO is the Michigan Department of Treasurys web portal to many business taxes. 20526 - Use tax registration.

2018 Sales Use and Withholding Taxes Annual Return. A copy of your insurance. Obtain a Duplicate Michigan Vehicle.

This license will furnish. Business entities that sell tangible goods or offer services may need to register for sales and use taxes. MICHIGAN SALES TAX LICENSE APPLICATION.

Vehicle registration transfer fee. A Michigan Tax Registration can only be obtained through an authorized government agency. The Michigan Department of Treasury offers an Online New Business Registration process.

The Michigan use tax should be paid for items bought tax-free over the internet bought while traveling or transported into Michigan from a state with a lower sales tax rate. Streamlined Sales and Use Tax Project. 2018 Sales Use and Withholding Taxes MonthlyQuarterly Return.

Valid signature valid title and an effective date of discontinuance. Welcome to Michigan Treasury Online MTO. Register for a Michigan Sales Tax License Online by filling out and submitting the State Sales Tax Registration form.

Michigan Sales Tax Registration Form will sometimes glitch and take you a long time to try different solutions. Treasury is committed to protecting sensitive taxpayer. In order to register for use tax please follow the application process.

Vehicle title late fee. How to register for a sales tax license in Michigan. Notice of New Sales Tax Requirements for Out-of-State Sellers.

An on-time discount of 05 percent on the first 4 percent of the tax. This process is easy fast secure and convenient. Michigan manages state payroll taxes through the Michigan Department of Treasury.

Do I need to register. As of March 2019 the Michigan Department of Treasury offers.

New Michigan Laws In 2022 Tampon Tax Repeal 2 Year Car Registration

Resale Certificate Michigan 2001 Form Fill Out Sign Online Dochub

Vtg 1936 Dog Tag License Tax Registration Washtenaw Co Michigan Token Exonumia Ebay

Form 163 Michigan Fill Out Sign Online Dochub

Michigan Llc How To Start An Llc In Michigan In 12 Steps Starting Up 2022

State Of Michigan Registration Form Mv Rd 108 Automotive Forms

Higher Gas Tax And Vehicle Registration Fees Now In Place For Michigan Drivers Wzzm13 Com

100 Free Michigan License Plate Lookup Get A Vehicle History Report

In 2017 Michigan Residents Will See Vehicle Registration Tax Hike

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller

National Register Of Historic Places Listings In Charlevoix County Michigan Wikipedia

Michigan State Taxes 2021 Income And Sales Tax Rates Bankrate

Michigan Sales Use Tax Guide Avalara

Michigan State Tax Golddealer Com

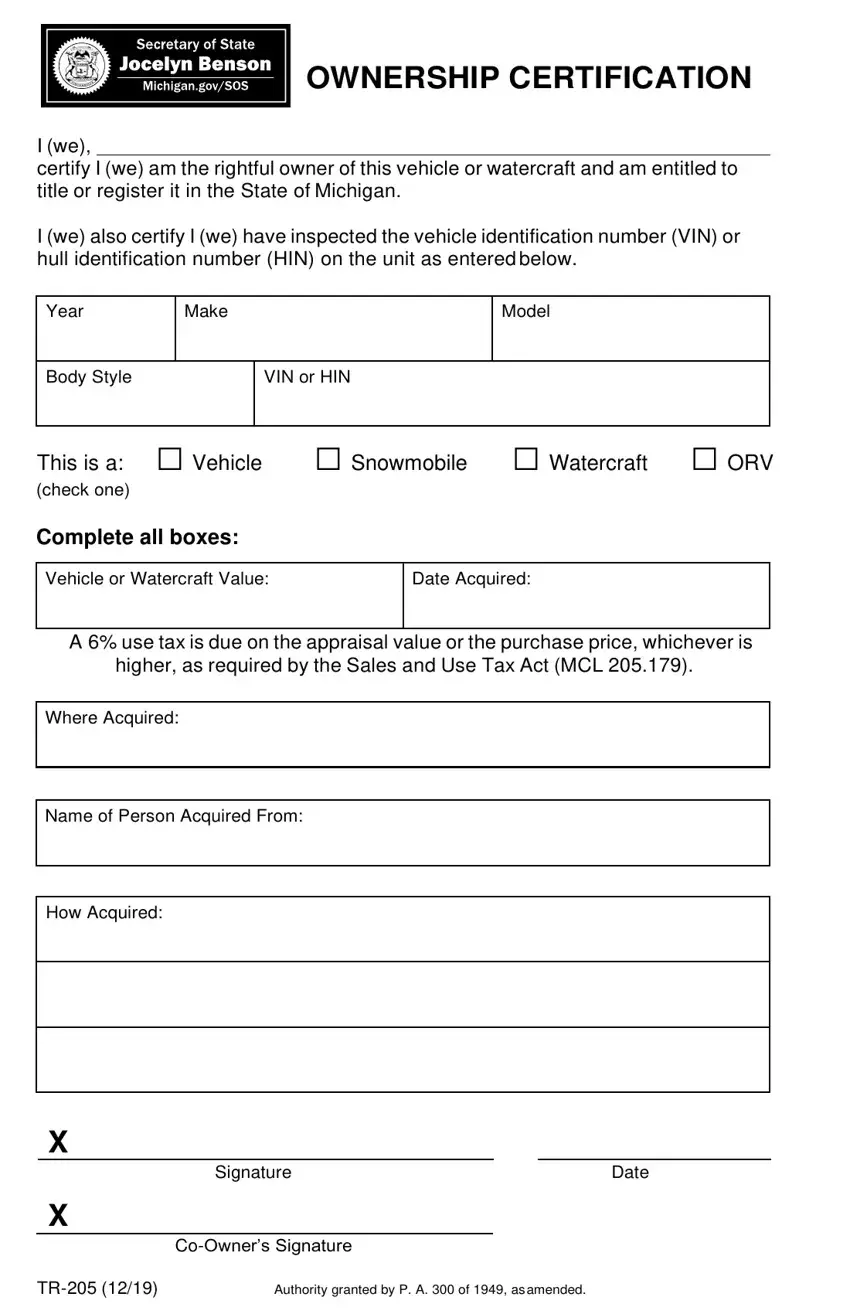

Michigan Tr 205 Form Fill Out Printable Pdf Forms Online

Michigan Resale Certificate Trivantage